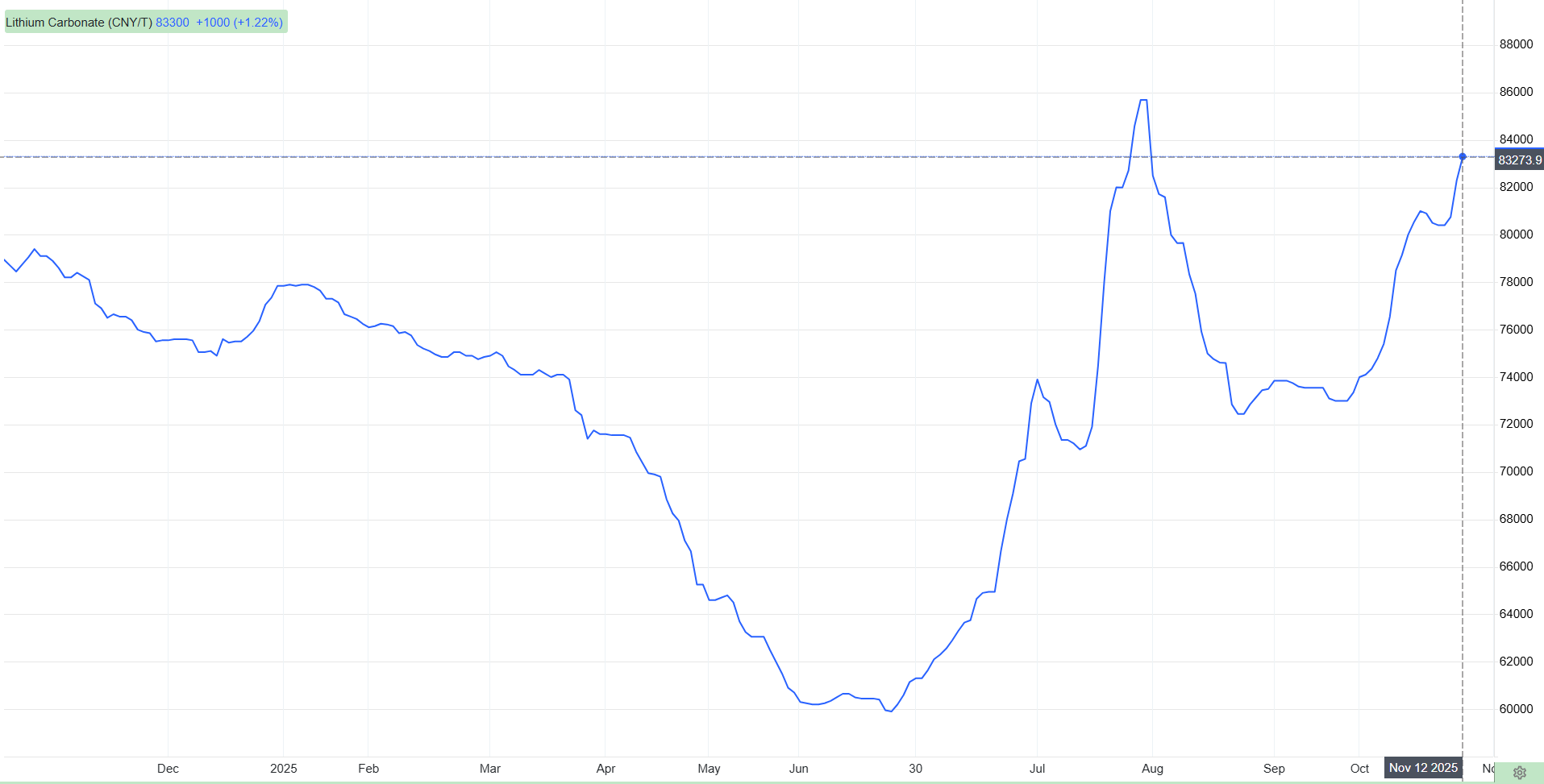

According to the recent market data, on November 10, the price of battery-grade lithium carbonate (early session) increased by 3,050 CNY per ton compared to the previous day, with the average price reaching 83,900 CNY per ton. At the same time, the main lithium carbonate futures contract rose by over 7%, hitting a nearly three-month high.

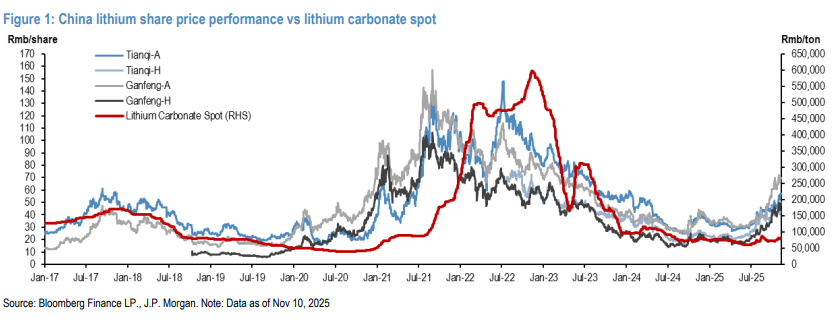

The current strength in lithium carbonate prices is mainly driven by demand-side factors, particularly stronger-than-expected demand in the energy storage field. Against the backdrop of sustained robust demand, price transmission effects across the energy storage industry chain have gradually become apparent.

▋ Lithium Carbonate Prices Rebound, Energy Storage Cell Prices Remain High

Since mid-October, lithium carbonate prices have shown a strong rebound. The average price of battery-grade lithium carbonate climbed from 73,000 CNY per ton on October 15 to 81,000 CNY per ton on November 3. After a slight dip to 80,400 CNY per ton on the 7th, it recovered to 80,750 CNY per ton on the 10th, reflecting a month-on-month increase of 350 CNY per ton.

Industry analysis points out that unlike the rebound in July and August, which was driven by domestic "anti-involution" policies and production cuts or suspensions at lithium mines in Jiangxi, this round of price increases stems more from robust demand-side pull and expected tightening on the supply side. Specifically, the new energy power battery market maintains steady growth, while demand in the energy storage market remains strong. Concurrently, expectations of seasonal winter production reductions in salt lake regions and continued inventory drawdowns further support prices.

Exclusively, J.P. Morgan has raised its energy storage battery production forecast for FY2025/26 by 50% and 43%, respectively, and shifted its medium-to-long-term energy storage demand outlook to a "shortage scenario." It projects global energy storage battery shipments to reach 1,630 GWh by 2030. Another institution estimates that energy storage battery shipments in 2026 will increase by nearly 600 GWh compared to 2024, corresponding to over 350,000 tons of lithium carbonate demand.

Regarding energy storage cells, prices remain at high levels, with transaction prices for both 314Ah and 280Ah cells at the upper end of their ranges. Statistics show that in October, the price range for 314Ah energy storage cells was 0.272–0.342 CNY/Wh, with an average price of 0.3076 CNY/Wh. Entering November, the average price for 314Ah cells slightly increased to 0.308 CNY/Wh. Since October, the price for 280Ah energy storage cells has remained stable between 0.274–0.332 CNY/Wh, averaging 0.303 CNY/Wh.

▋ Slight Decrease in Average Price for Commercial and Industrial Energy Storage

Data indicates that the average price for commercial and industrial integrated energy storage cabinets (215 kWh) slightly decreased from 0.65 CNY/Wh in September to 0.63 CNY/Wh in October. The overall price range remained between 0.51–0.73 CNY/Wh, showing a relatively stable trend.

Despite rising cell costs, the overall price of commercial and industrial integrated energy storage cabinets did not follow the upward trend but instead experienced a slight decline. This reflects a shift in the internal competitive dynamics of this sector. With an increasing number of market participants, intensifying product homogenization, and adjustments in time-of-use electricity pricing policies across various provinces this year, investment in commercial and industrial energy storage projects has become more rational. In the competition for limited orders, most companies remain caught in low-price competition, with some quotes hitting new lows, collectively suppressing and offsetting the weak cost transmission from the cell side.

Hot News

Hot News2026-01-16

2026-01-08

2025-12-04

2025-11-14

2025-09-08

2025-07-28

● Fill out the form with your needs, we will get back to you within 24 hours.

● Need immediate help? Call us!